Protect your business, your family, and your wealth.

For entrepreneurs, founders, CEOs, and high-net-worth families with complex estates who want to minimize taxes and shield assets from creditors, disputes, and predators.

Business Law and Exit Planning, Complex Estate Planning, Asset Protection & Tax Strategy

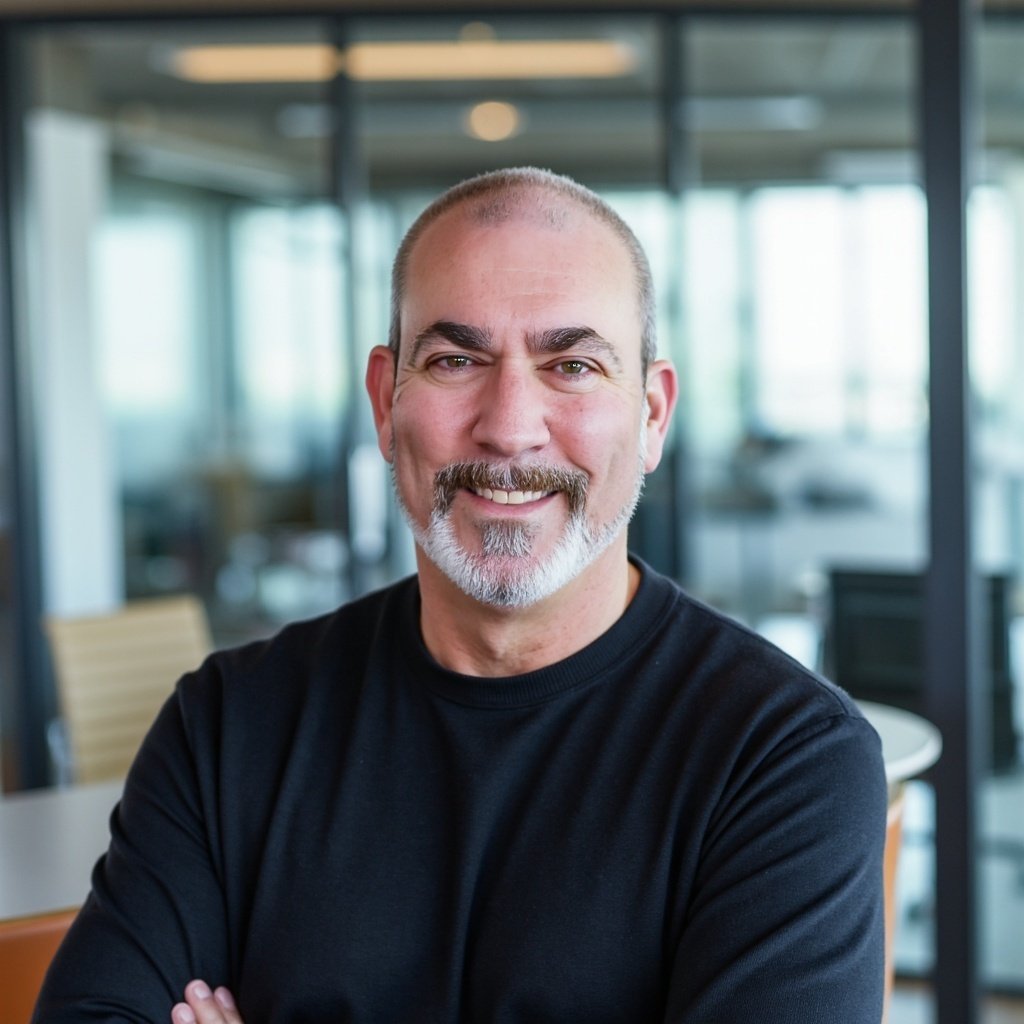

Wayne Zell - Exit Planner | Attorney | Tax Expert | CPA | Author | Speaker

Wayne is a nationally recognized thought‑leader in exit planning, management succession, tax, and estate planning, backed by 40+ years of experience guiding entrepreneurs and high‑net‑worth families through complex transitions. As a client, you benefit from his award‑winning insight, sophisticated tax‑efficient strategies, and clear, practical guidance for your most sensitive business and estate matters.

The Book Every Entrepreneur Should Own

Establishing a solid exit strategy for your business from the very start is an essential blueprint for building wealth.

“Your Multimillion-Dollar Exit” by Wayne M. Zell is a comprehensive guide for entrepreneurs planning to sell their businesses. As a Certified Exit Planner (CExP), Wayne has successfully facilitated hundreds of transactions, helping clients earn millions while maximizing savings through effective tax planning strategies.

Learn More About the Book

“This book is the ultimate roadmap for entrepreneurs looking to cash in on their hard work. Practical, insightful, and inspiring.” - Business Floss (Entrepreneurship)

— Barbara Corcoran, Founder of The Corcoran Group and Shark Tank Investor

Discover Legal and Business Secrets. Amazon Best Seller and Winner of 5 Prestigious Book Awards.

Book Reviews

ENTREPRENEUR.COM

"4 Books for Entrepreneurs Looking to Break the Mold - Your Multimillion-Dollar Exit covers preparing for "unexpected" exits (death and disability), leveraging a high-quality team to advance your exit strategy, reducing the tax hit from a sale or transfer, avoiding common pitfalls that erode business value, negotiating like an investment banker and more. By the end, you'll understand your business' potential value and have the tools to unlock it.”

FORBES.COM

“9 Books for Business Owners Planning to Sell - Your Multimillion-Dollar Exit Why You Should Read It: Selling your business can be hard but this easy-to-follow planner is designed to help entrepreneurs exit their businesses on their terms. Using real-world examples, checklists, and actionable advice, this book is about selling smart and achieving maximum value for the time and effort you’ve put into your company. “

ISSUEWIRE.COM

“9 Important Books for Business Owners Who are Seeking to Sell - Your Multimillion Dollar Exit Selling your business is not an easy task and it comes with a lot of planning and execution. This book can help to come up with a better strategy, especially for entrepreneurs and small-scale business owners. The book offers real-life references along with checklists and proper actions. Time to rethink the value, time, and effort you gave to your company.”

Featured Post and Events

Practice Areas

Business Exit Planning

Creating a clear exit strategy for selling or transferring ownership of your business is vital for its long-term stability and your peace of mind. I help you set clear exit objectives, assess resources, and develop a succession plan that aligns with your estate planning, ensuring a smooth transition and protecting the business’s value and your legacy.

Learn More

Business and Tax Law

Businesses face a variety of challenges throughout their lifecycles. Effective business law planning can help you prepare by enabling you to understand the best legal structure for your business, how to minimize taxes, the methods for raising financing, how to compensate your team, and how to manage transactions of all sizes.

Learn More

Estate and Tax Planning

Effective estate planning is vital for managing your assets during your lifetime and preparing for the future, including if you become incapacitated or pass away. Your plan should consider all your assets and specify who, when and how they will inherit them. We help clients create a clear estate plan that minimizes wealth transfer taxes and protects assets for creditors and preditors.

Learn More